A 50 lakh health insurance makes your insurance plan more effective and comprehensive with a high sum insured. This is the maximum claim amount that your insurance provider will pay and it can easily cover large medical expenses. You can get affordable premiums for such plans by customising them based on your specific medical needs. Insurance with 50 lakh sum insured can give you access to speciality hospitals and treatments, offering you peace of mind and cashless hospitalisation benefits.

1 Crore Health Plans starting @₹18/day*.

We pay 100% of your hospital bills

From syringes to surgeries

No limit on hospital room rent

No compromises on recovery

A ₹50 lakhs health insurance means that you will be covered for ₹50 lakhs for hospitalisation and related expenses. It meets significant medical expenses and binds you and your family with adequate protection against high-cost treatments without a shortage of provisions.

Health insurance is a great way to protect yourself and your family from unexpected medical expenses. Choosing a plan with higher coverage, such as ₹50 lakhs, gives you broader protection and greater peace of mind. Following are the perks of having a ₹50 Lakh Health Insurance plan

A ₹50 lakh policy takes care of most medical expenses, from emergency surgeries to regular treatments, so you don’t have to worry about heavy hospital bills.

You can get instant access to medical treatment without paying a large sum by opting for cashless hospitalisation. Visit a network hospital, show your health card, and get the necessary approvals for the treatment to begin.

Health insurance premiums are eligible for tax deductions under Section 80D of the Income Tax Act. You can claim up to ₹50,000 if you are under 60 and up to ₹1 lakh if you are a senior citizen.

Critical illnesses can lead to expensive treatments but a ₹50 lakh cover helps you manage these expenses with ease.

You can customise your plan with add-ons such as maternity cover, pre-existing disease coverage or wellness benefits to suit your family’s needs.

A large cover can be shared across your family, making it cost-effective and practical when more than one member needs hospital care.

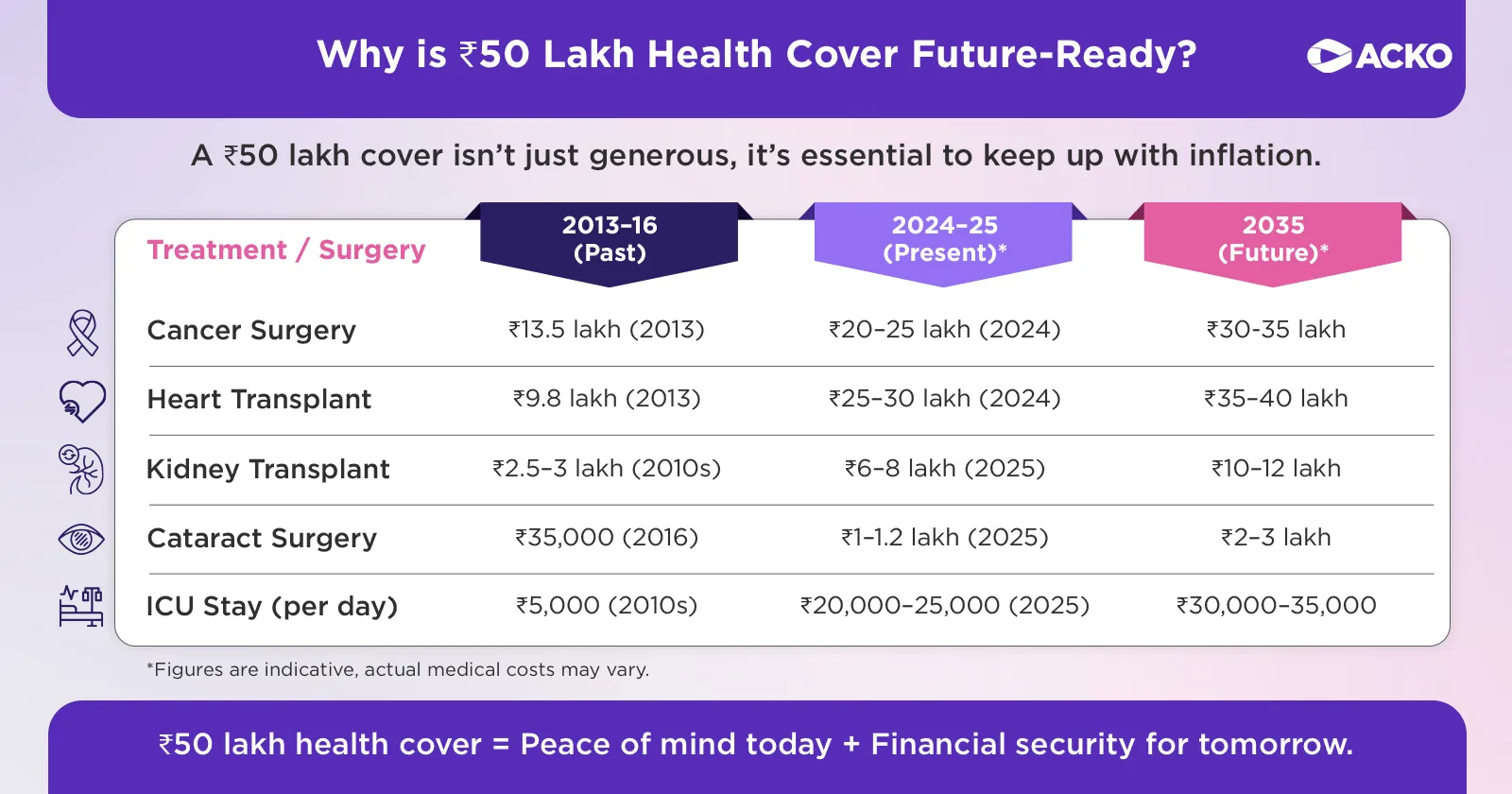

Medical inflation is on the rise. With a higher sum insured like ₹50 lakhs, your policy remains sufficient and relevant even in the future.

Knowing you have strong financial backup gives you confidence and relief, especially in medical emergencies.

Compared to other standard plans, ACKO Standard Plan with Rs. 50 lakhs sum insured offers more benefits. Here’s how these benefits can help you.

You probably won't need top-ups or super top-ups with a high sum insured of Rs. 50 lakhs. However, if your sum covered is ever used up, you have the choice to restore 100% of your Rs. 50 lakhs sum insured.

While purchasing a health plan, you are typically asked to pay a separate premium for buying an add-on. However, valuable add-ons like Doctor on Call, Room Rent Waiver, etc., are already included in your ACKO policy.

Hospitalisation costs won't be a concern because you will always have a high and sufficient sum insured with our Rs. 50 lakhs health plan.

People typically buy a dedicated policy to cover critical illnesses at a high premium because the associated treatment is expensive. With our Rs. 50 lakh health plan, you will not require a separate insurance policy to cover these costs. We will cover hospitalisation expenses for critical illnesses under this plan.

ACKO Health Plan with a ₹50 lakh sum insured offers peace of mind as you are sure that your insured members will get the necessary medical treatment at the right time. You don’t need to worry about arranging the money by using your savings or asking for help.

Every health insurance plan can have a different set of inclusions and exclusions. It is important that you go through these while buying the plan.

General inclusions of 50-lakh health insurance include the following.

✅ Medically necessary hospitalisation

✅ Post-birth complications

✅ Wider coverage for pre and post-hospitalisation

✅ Multiple ambulance trips

✅ Domestic Emergency Evacuation

✅ Organ donation expenses

✅ Second opinion consultations

✅ Annual preventive health check-ups

✅ Inflation protect sum insured

✅ Restore sum insured

❌ Undisclosed pre-existing diseases

❌ Sterility and infertility treatment

❌ Maternity expenses

❌ Change-of-gender treatments

❌ Vision correction surgery for less than 7.5 dioptres

❌ Cosmetic surgery, unless necessary due to an injury

❌ Dental treatment unless required due to an accident

❌ Weight control surgery

❌ Resuscitation treatment for attempted suicide

❌ Supplements and hormonal therapy

If you are a healthy individual, a ₹50 lakh coverage might seem unnecessary but considering the inflation and rising medical costs a high coverage is important. Here is a list of people who would benefit from buying a high health insurance coverage.

Smokers, or individuals with a stressful job are at a higher risk of health issues can benefit from a high sum insured.

Families with a large number of dependent members like children, or old parents may have regular medical needs. Such families can use a large sum insured of ₹50 lakh.

Those who suffer from pre-existing conditions may need regular treatments. These could cost a large sum of money and a high sum insured plan can help manage the finances.

Some families can have a history of critical illnesses like cancer. Here it would be helpful to buy a high sum insured plan and create a safety net in advance.

You can keep some basic things in mind while paying a ₹50 lakh health insurance premium for you and your family.

It will help to note down your health insurance needs and then find a suitable plan. You can consider your family size, budget, medical conditions, etc.

Once you note your requirements, look for a plan that offers suitable coverage. For example, if you or your family members have diabetes, look for a plan that covers this condition without extended waiting periods.

After narrowing on a few suitable policies, you can check each insurance company’s claim settlement process. Go through their website or social media handles to see how happy existing customers are.

While the recent “Cashless Everywhere” facility will eliminate the need for checking network hospitals when buying a plan, it might take some time for this to be available all across India. Until then, choose an insurance company with a high number of network hospitals.

Like other health insurance plans, a ₹50 lakh mediclaim policy also offers financial backup in case of covered medical events. Let’s look at this process in detail.

You can raise a cashless or an reimbursement claim depending upon the hospital you choose to take treatment at.

Here’s how you can apply for a 50L ACKO Standard Plan.

Visit www.acko.com or download the ACKO app.

Use your mobile number to create your ACKO account and share basic details related to you and the people you want to cover.

Just answer a few questions, review the plan, and make payment. We will review your application and get in touch with you for the next steps.

Along with the benefits and features of our wide-ranging cover mentioned above, here’s what makes ACKO one of the best options for purchasing health insurance.

You can benefit from the cashless claims facility across 11,500+ hospitals with a tie-up with ACKO. Call us to raise a cashless claim, and we'll assist you.

We are trusted by more than 8 crore people for their insurance requirements. Our offerings cover a variety of categories, including those for group medical insurance for employees and motor insurance.

Got a question racing through your head? Please visit our support centre at https://www.acko.com/contact-us/ for any assistance.

A ₹50 lakh health insurance plan doesn’t have to be costly. At ACKO, we make it easy and affordable to get big coverage without the extra stress. Your premium will depend on factors like age, medical history, dependents, and location. The plan you choose and any add-ons also affect the price. With ACKO, you get transparent pricing, no hidden charges, flexible options, and wide coverage that truly protects you and your family. To know your premium, just answer a few quick questions on the ACKO app and get your personalised quote in minutes. The ₹50 lakh health insurance plan can be pretty affordable for you at ACKO.

Following are the reasons why you should buy the ₹50 lakhs medical insurance from ACKO.

Usually, during a health insurance claim, you must pay additional, non-negotiable hidden fees, such as mandatory out-of-pocket expenses, copay, and other medical expenses. Although these expenses might not seem like much when taken separately, they can add up over time, and most insurance policies do not cover them. Remarkably, all these charges are covered in the ₹50L ACKO Standard Plan. This makes the plan comprehensive allowing you to focus solely on improving your medical condition without worrying about getting charged for additional services.

When you opt for the ₹50L ACKO Standard Health Insurance Plan, you unlock the No Room Rent Capping add-on. This grants you the flexibility to pick the hospital room of your choice, free from financial worries. We will fully cover the room rent without any proportional deductions from your claim amount.

Nowadays, you can practically access anything instantly on your phone, including health insurance. Before the advent of the internet, buying health insurance required a significant time commitment. You had to gather the necessary paperwork, visit the insurance provider, or meet with a middleman to help you choose the best plan. Things changed with digital-first insurers like ACKO.

The online process is considerably more time-efficient. Just use your computer or smartphone to research, compare health insurance policies, and select an appropriate policy. As was the case earlier, you no longer need a middleman to assist you in purchasing the plan. Moreover, you get the policy document almost instantly with online health insurance.

Anyone who is 18 years of age or above can purchase the ACKO Standard Plan with Rs. 50 lakhs sum insured. Six dependents, including two adults over 18 and children between the ages of three months and 25 years, can be insured under this plan.

There’s no unnecessary physical form filling and tedious document submission involved when you are buying a health plan from us. Here are some basic documents that you need to upload.

It's pretty simple to submit a claim for your Rs. 50 Lakhs Health Insurance Plan. All you need is a smartphone with an active internet connection. Download the ACKO app to your phone, create your account, and raise a claim from anywhere by following the easy steps mentioned during the claims process.

The ACKO Standard Health Plan has waiting periods that take effect upon policy purchase. Here's an overview of how these waiting periods work.

You cannot get coverage for treatments for 30 days starting from the first day of your policy. However, accident claims are allowed.

Certain medical conditions become eligible for insurance coverage after a waiting period of 2 years. The specific ailments covered are detailed in the Policy Wordings.

Coverage for pre-existing diseases comes into effect after 3 years of policy acquisition, provided the policy is consistently renewed without any breaks.

ACKO ₹50 Lakh Standard Health Insurance Plan has features such as a sum insured of Rs. 50 lakh and there are no restrictions on the room rent or non-medical expenses. As simple as the online process is, this plan protects you and your family from massive medical bills.

Here are some queries you might have about the 50L ACKO Standard Plan or even about health insurance in general.

Disclaimer: The content on this page is generic and shared only for informational and explanatory purposes. It is based on industry experience and several secondary sources on the internet; and is subject to changes. Please go through the applicable policy wordings for updated ACKO-centric content and before making any insurance-related decisions.