Health insurance, also called medical insurance, offers financial protection for you and your family members in case of a medical emergency for a monthly or yearly premium amount. By buying health insurance, policyholders can access quality medical treatment at top hospitals without worrying about paying the bills.

1 Crore Health Plans starting @₹18/day*.

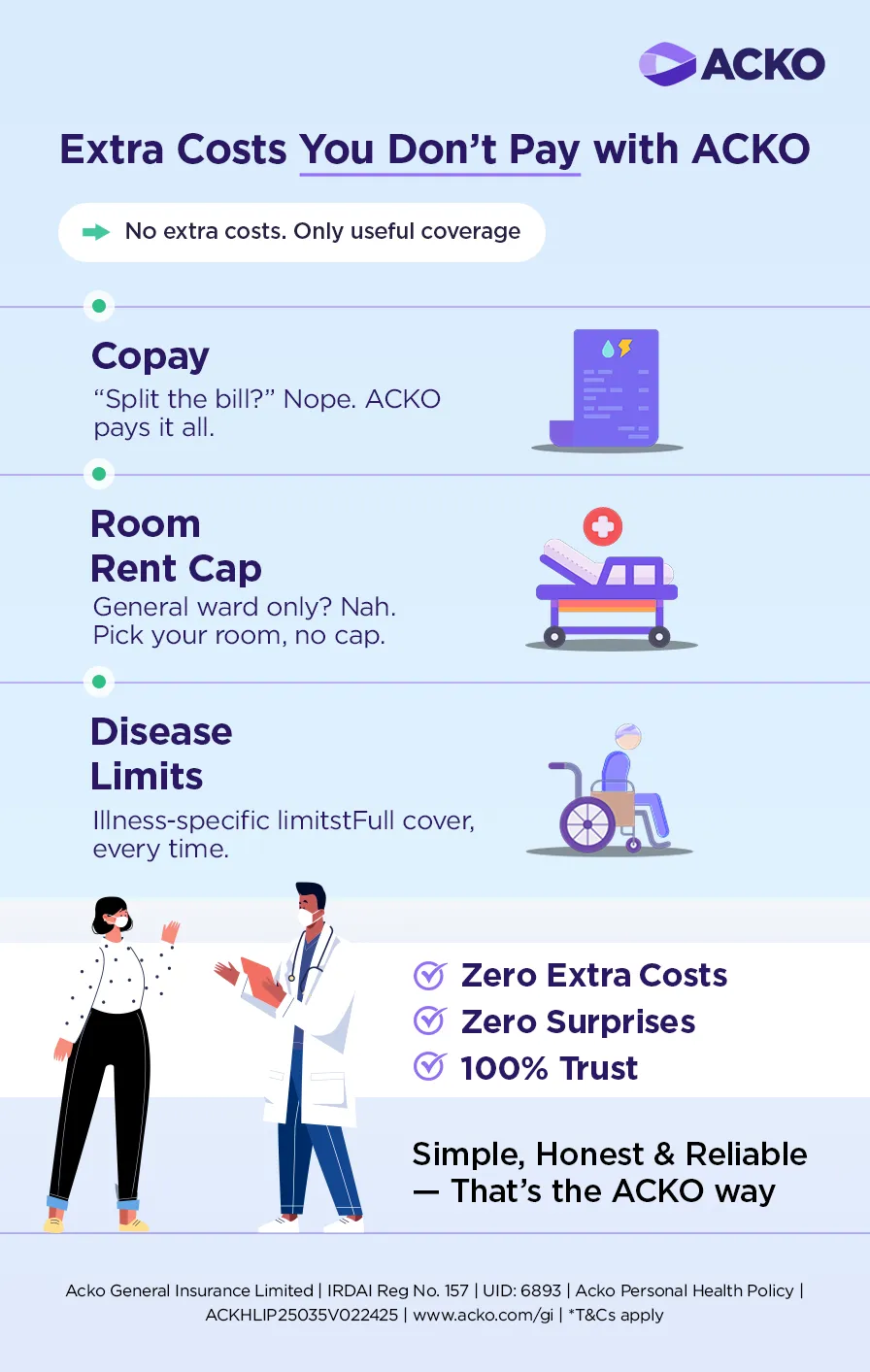

We pay 100% of your hospital bills

From syringes to surgeries

No limit on hospital room rent

No compromises on recovery

Health Insurance

In simple terms, health insurance is a plan that helps you or your family cover medical bills when you're unwell or injured.

Health Insurance policies will provide coverage & benefits for:

Here is a quick look at ACKO Health Insurance Plans.

| Categories | Specifications of ACKO Health Insurance Plans |

| Premium | Starting at ₹18/day* as per plan type |

| Sum Insured | ₹10 Lakhs to Unlimited |

| Hospital bill coverage | No deductions. Get 100% coverage for hospital bills up to the sum insured |

| Pre & Post-hospitalisation Expenses | Covered |

| ICU Charges | Covered |

| Pre-existing Diseases | Covered as per T&C |

| Room rent limit | No limit on room rent. Available up to the sum insured. No deductions. |

| Ambulance Cover | Available |

| Day Care Procedures | Covered |

| Co-pay | None |

| Waiting period | Zero waiting period with ACKO Platinum Health Plans |

| Cashless claims at top hospitals | Available across 11,500+ network hospitals. |

| Claim process | Fully digital, simply upload the necessary documents on the app. |

| Tax Benefits | Up to ₹75,000 per financial year |

Max healthcare

Manipal hospitals

Fortis hospital

Apollo hospitals

Narayana hospital

Aster Hospitals

The ideal health insurance coverage for an Indian family with aging parents, spouse, and children can be twice the family’s annual income considering factors like medical inflation. However, you can choose to get higher or lower coverage as per your needs. Opting for a ₹10 - ₹25 lakhs can prove to be sufficient for one year.

Here are the other factors you can consider to calculate your ideal coverage.

Say for example you live with your family in a tier one city where healthcare is costly. Your ideal coverage can be between ₹25 to ₹50 lakhs. But if you stay alone in a tier 3 city, then a health cover of around ₹5 lakhs can be sufficient. Here is an overview of coverage and premium in different types of cities:

Health insurance should help you focus on recovery, not bills.

That’s exactly what our customers experience — no delays, no hidden surprises, just genuine support when it matters the most.

Rated 4.6/5 with over 13625 reviews on Google

See all reviews

The top reasons to buy a health insurance plan are medical inflation, instant and better healthcare, medical emergencies, protection against using saved money for treatment, tax benefits, and more. Let’s deep dive into each one of these reasons.

A minor medical procedure like the cataract surgery that was priced at around ₹10,000 to ₹15,000 a few years back can now cost ₹80,000 for each eye. Such rising healthcare costs can lead to you losing your life savings. But the right medical insurance plan can provide financial relief in case you or a family member needs treatment.

Let’s deep dive into more reasons to buy health insurance.

Here is a quick checklist for buying health insurance in India.

Note: There is no waiting period under ACKO Platinum Plan. So you get coverage from day 1 if you disclose all pre-existing conditions you are suffering from.

The benefits of buying health insurance plans online are convenience, easy comparison, discounts, transparency, secured payments, and more. Let’s deep dive in each one of these benefits.

The key benefits of health insurance plans in India are coverages like hospitalisation, ICU charges, pre and post-hospitalisation expenses, ambulance charges, and more. Let's understand each benefit in detail.

Some situations and medical treatments are excluded from the coverages of health insurance in India. Here are a few common exclusions.

Do check your health insurance policy for a complete list of what is covered and what is not covered.

Following is a list of different types of health insurance plans in India.

Health insurance riders are extra coverages which you can buy separately to increase the total coverage. They can slightly increase the premium but provide more benefits at the time of claim. This increase in premium will depend on factors such as number of insured members, age, location, type of policy, the amount of sum insured, etc. Here are some common health insurance add-ons you can opt for.

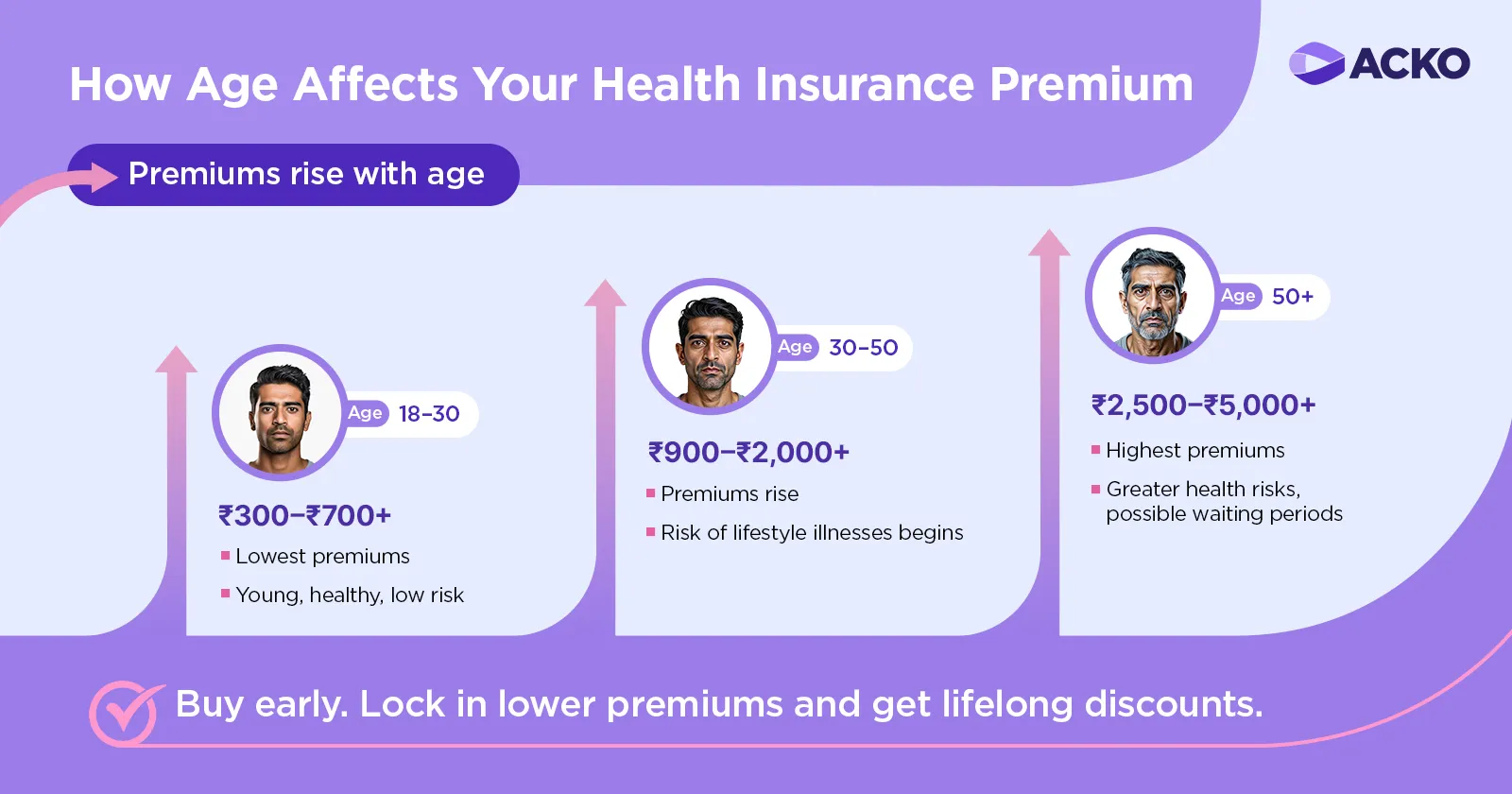

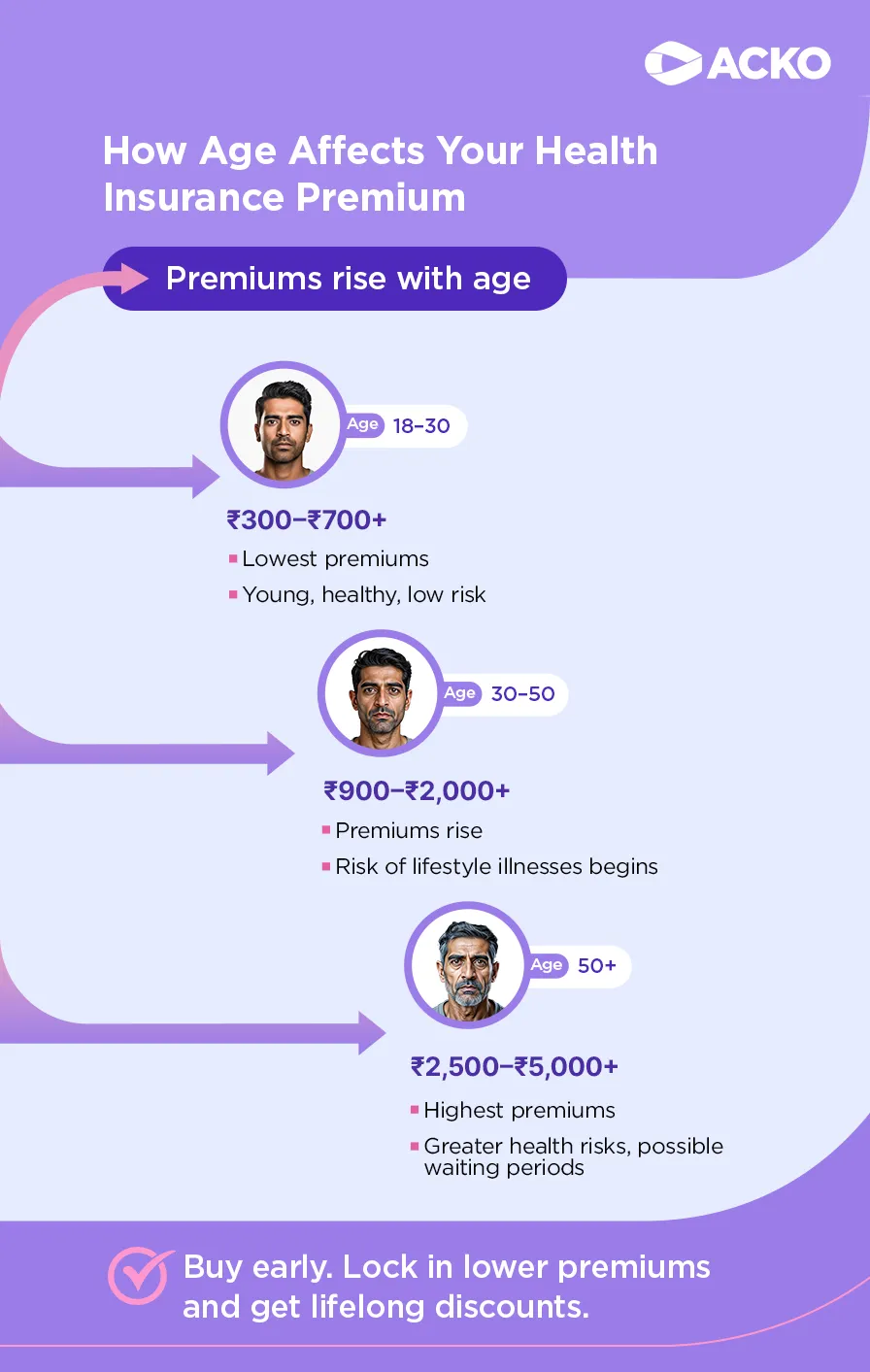

The best health insurance plan for different life stages will depend on your medical needs at that particular age. These needs change as you move through life. The plan that works in your 20s might not be enough in your 40s. Here’s how to pick the best health insurance plan based on your age and life stage.

Whether you're single, married, or retired, there’s a health insurance plan that fits your life stage and needs. At ACKO, we make it simple to choose, customise, and buy your plan, all online, with no middlemen.

Yes, most health policies cover coronavirus treatment; however, please check the applicable policy wordings to confirm the same. IRDAI has directed all general insurers to offer coverage for coronavirus treatment through health plans. Here are the two COVID-19 plans offered by all general insurance companies.

The eligibility criteria to buy a health insurance plan are factors such as age of the oldest insured member, medical history, nationality, etc. can influence the eligibility criteria to buy a health insurance plan. Here is an overview.

| Criteria | Eligibility |

| Age of the policyholder | The entry age is usually 18 years. |

| Children | Dependent children are eligible from the age of 90 days to 25 years. |

| Pre-policy medical check-up (PPMC) | Insured members over the age of 18 years may have to undergo PPMC |

| Nationality | Indian nationals and NRIs can buy health insurance in India |

Things that are covered in a health insurance plan are listed below.

Here are the key differences between a mediclaim policy and health insurance.

| Factors | Mediclaim | Health Insurance |

| Sum insured | Limited sum insured, usually up to ₹5 lakhs. | Choose from a wide range of options, usually from ₹5 lakhs to an unlimited sum insured as per your family needs. |

| Scope of coverage | Limited to hospital bills | Multiple options starting from pre and post-hospitalisation, hospitalisation, pre-existing diseases, doctor’s fees, diagnostic tests, second opinion, and more. |

| Add-ons | Mediclaim plans usually do not offer add-ons | Choose from add-ons like Room rent waiver, Non-medical charges waiver, Doctor on-call, Critical illness, Personal accident, etc. |

| Options to customise | These are standalone policies with limited or no scope for customisation. | Offer the flexibility to customise the plan as per individual needs. |

You can file a health insurance claim in two ways, one is a cashless claim where you visit a network hospital (or soon a non-network due to the “Cashless Everywhere” directive). Another method is the reimbursement claim. Here is a deep dive in both types of claims.

You can visit any hospital, get the treatment and then raise a health insurance claim. The insurance company will settle the applicable part of your hospital bill.

You can visit a network hospital and get the necessary treatment. Then settle the hospital bill and raise a claim for reimbursement.

Here are the steps to file a health insurance claim depending upon the type of hospitalisation.

Date: 04-Sept-2025

GST will not be charged on health and life insurance premiums starting from 22 September 2025. The removal of GST will help reduce the premium amount by 18% which was the applicable GST on these plans.

How will this affect the insured and the insurance industry?

More such announcements are expected in the future. These are a part of a plan to simplify tax slabs, make essentials more affordable, and increase tax on luxury goods.

Read more: Zero GST on Health Insurance

The steps to buy the right health insurance plans online from ACKO are listed below. But first, we're really excited that you're interested in purchasing our health care insurance policy! It's an important step towards protecting yourself and your family. We want to express our gratitude for considering us as your trusted insurance provider.

Buying our mediclaim policy online is simple and convenient. Just follow the steps below, and we'll ensure you get the best health insurance coverage in India. Let's embark on this journey together and secure a healthier future for you and your loved ones!

When it comes to health insurance plans, there is no universal policy that fits everyone. It's similar to shopping for clothes, where different plans offer varying coverage, benefits, and premiums.

Therefore, it's essential to do some comparison to find the one that suits your needs. We have provided a quick overview of how our health insurance plans measure up against others.

| Criteria | Other Market Health Plan | ACKO Standard Health Insurance Plan | ACKO Platinum Health Insurance Plan |

| HOSPITAL BILLS | They Pay ~85% | ACKO pays 100% | ACKO pays 100% |

| ROOM RENT LIMIT | Pay extra for room upgrades | No Room rent limit | No Room rent limit |

| WAITING PERIODS | 30 days initial | 30 days initial | None initial |

| COPAY | Fixed Copay | No Copay | No Copay |

| DISEASE-SPECIFIC WAITING PERIOD | 2 years Specified illnesses | 2 years Specified illnesses | None Specified illnesses |

| PRE-EXISTING DISEASES WAITING PERIOD | 3 years Pre-existing diseases | 3 years Pre-existing diseases | 0-3 years Pre-existing diseases (based on health evaluation) |

You can choose ACKO health insurance because of the following reasons.

Whether you're looking for a basic plan or a more comprehensive one, we have something for everyone.

ACKO Health Insurance is cheaper than other insurance because it provides cost-effective health insurance policies through its online distribution model. Traditional health plans in India are usually sold through agents and brokers who earn a commission from the insurance company.

These costs are passed on to policyholders as distribution costs, leading to higher premiums. However, ACKO's online platform eliminates the need for intermediaries and allows customers to directly purchase from us.

No agents in the mix.

Just you and us.

Zero commissions means more savings for you

Convenient direct claim assistance through our app

Expert guidance on the best plans for you

India's medical inflation has been on the rise. According to the Ministry of Statistics and Programme Implementation (MOSPI) report, medical inflation in 2021 was at 14%, and PwC's Health Research Institute (HRI) report predicts a 6.5% increase in medical costs in 2022.

Mediclaim policy in India can help reduce the impact of medical inflation on your finances and out-of-pocket expenses, especially with features like Inflation Protect and Zero Deductions at Claim.

| PARAMETER | ACKO INFLATION PROTECT | NO CLAIM BONUS |

| Sum Insured | Every year irrespective of claim in previous year | Only if you did not claim in previous year |

| Upper limit on Sum insured | Capped at 100% | Capped at 50-100% |

| Increment % | 10% fixed increment every year | Resets to zero if you claim and then starts again |

| SPECIFICATIONS OF ACKO Health Plans | What do ACKO Health Plans offer? |

| Sum Insured | ₹1 Crore and Unlimited sum insured |

| Waiting Period | Zero Waiting Period. Coverage begins from Day 01 |

| Cashless Hospitalisation | 11,500+ Pan India Network Hospitals |

| Add-ons | ✅ Non-medical expenses ✅ Room rent waiver ✅ Doctor on call |

| Deductions on claims | Absolutely ZERO Deductions |

| Middleman commission | None, we cater directly to you |

| Pre-hospitalisation Expenses | 60 days |

| Post-hospitalisation Expenses | 120 days |

| Restore of sum insured | Allowed unlimited times |

| Covid-19 Treatment | Hospitalisation costs covered after 30 days |

| AYUSH Treatment | Requires minimum 24 hrs of hospitalisation |

| Tax benefits (80D) | ✅Yes |

| Quick claim settlements | ✅Yes |

| No Room Rent Cappings | ✅Yes |

| Health Insurance Portability | ✅Yes |

| SPECIFICATIONS OF ACKO Health Plans | What do ACKO Health Plans offer? |

| Sum Insured | ₹ 10 Lakhs, ₹ 25 Lakhs, ₹ 50 Lakhs, ₹1 Crore |

| Cashless Hospitalisation | 11,500+ Pan India Network Hospitals |

| Add-ons | ✅ Non-medical expenses ✅ Room rent waiver ✅ Doctor on call |

| Deductions on claims | Absolutely ZERO Deductions |

| Middleman commission | None, we cater directly to you |

| Pre-hospitalisation Expenses | 60 days |

| Post-hospitalisation Expenses | 120 days |

| Restore of sum insured | Allowed unlimited times |

| Covid-19 Treatment | Hospitalisation costs covered after 30 days |

| AYUSH Treatment | Requires minimum 24 hrs of hospitalisation |

| Tax benefits (80D) | ✅Yes |

| Quick claim settlements | ✅Yes |

| No Room Rent Cappings | ✅Yes |

| Health Insurance Portability | ✅Yes |

The add-ons included in ACKO Platinum Health Insurance Policy are non-medical expenses waiver, room rent waiver, doctor on call, etc. Health Insurance Plans add-ons enhance the coverage of a regular health plan. So we have included some useful ones in the base health plan itself. Check more details below.

Inclusions are among the most important aspects of a Health insurance Plan. They help you understand the scenarios when you can raise a claim against your policy. Here are the typical inclusions or coverages you get when you buy health policy. However, this may vary for different health policies.

Every insurance company has a set of scenarios where the policyholder cannot raise a claim. These scenarios are called exclusions. Here is a list of exclusions of an individual medical insurance policy that you should be aware of.

Let's make sure you're covered and worry-free! These are our basic eligibility criteria.

Note: It is mandatory for members over 18 years to undergo medical screenings when they buy health insurance. We call these tests Per-Policy Medical Checkup (PPMC). They are completely free.

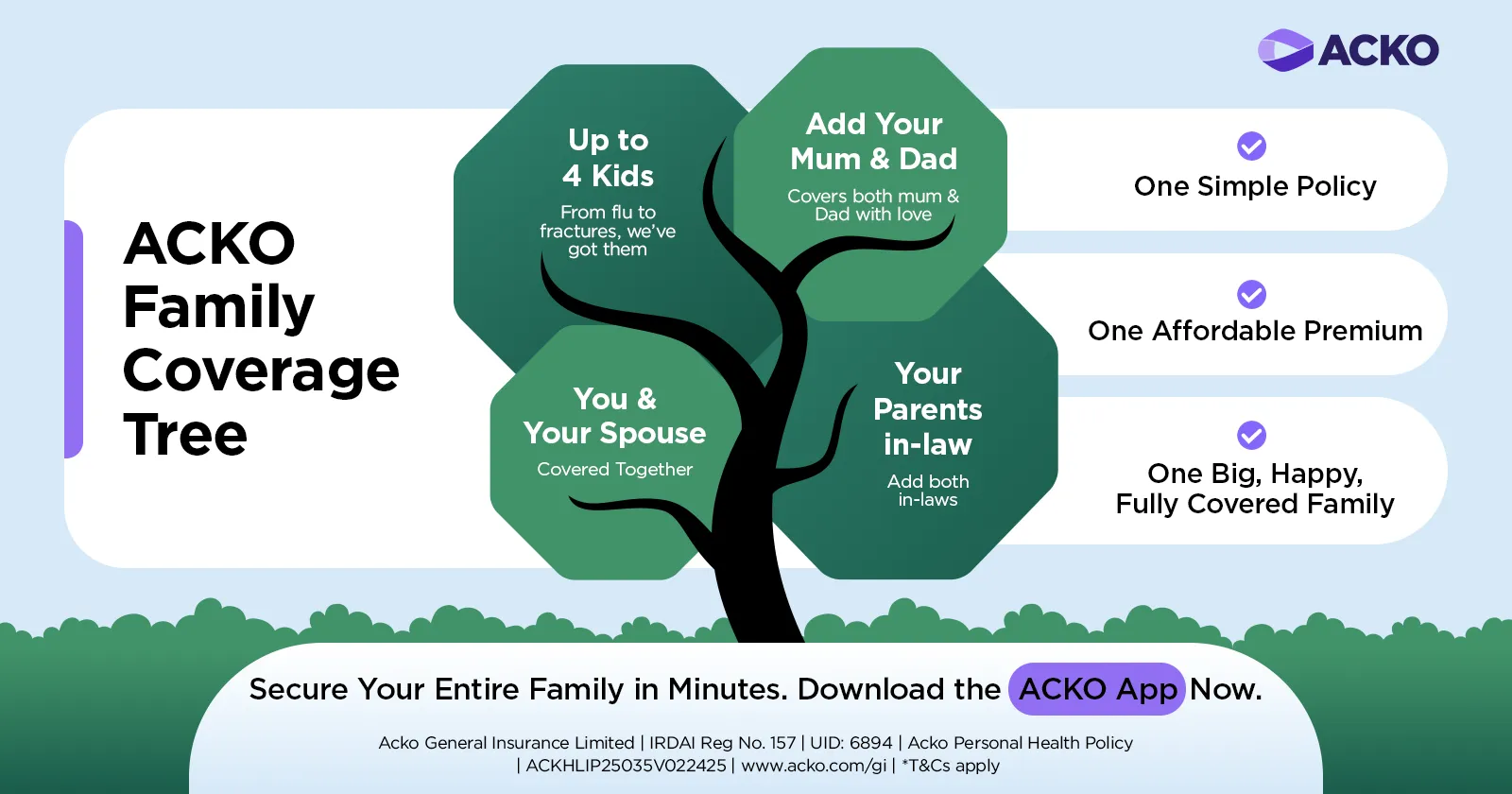

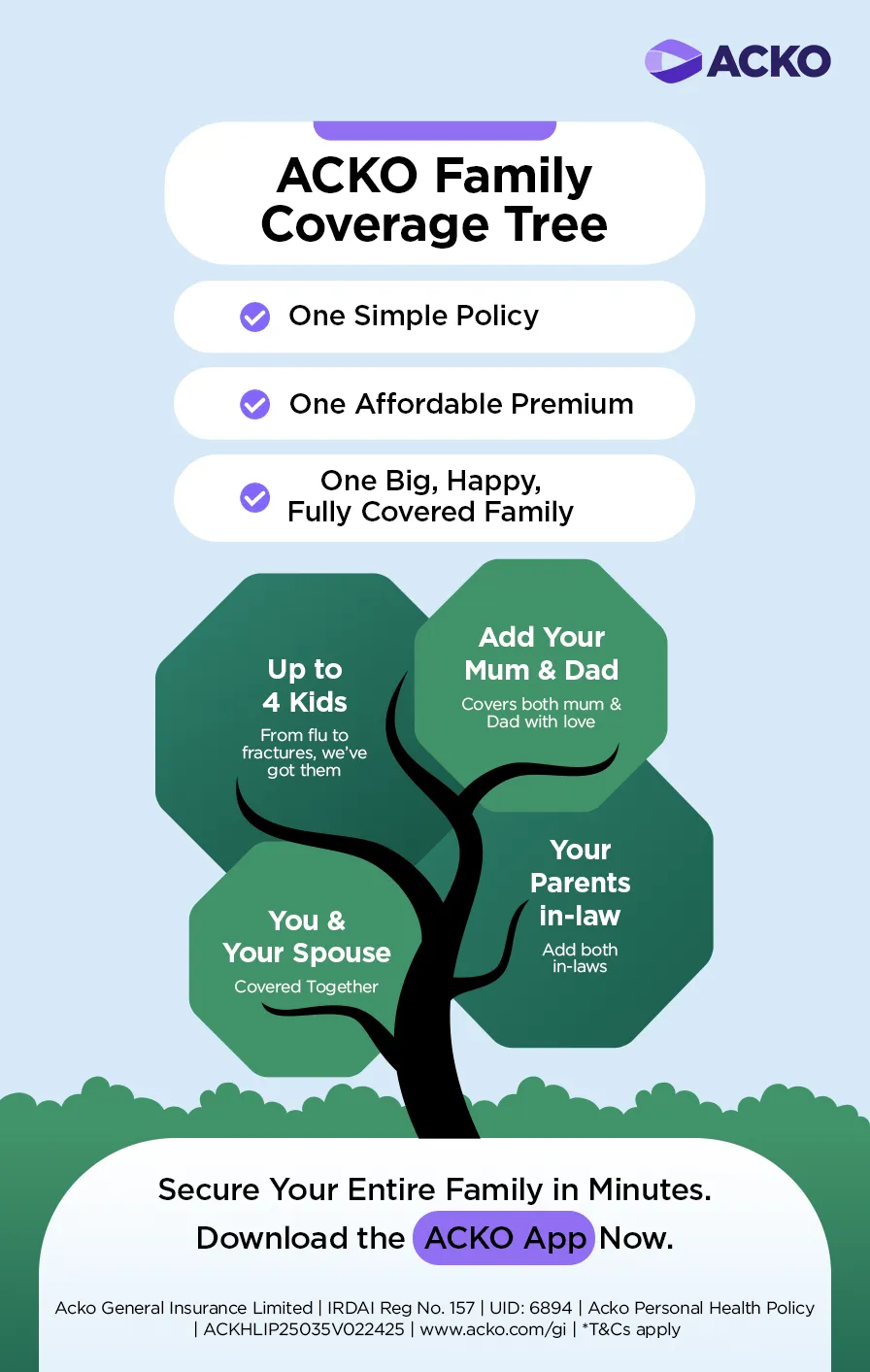

You can add up to ten members to your ACKO Platinum Health Insurance Policy, including two adults, two parents, two parents-in-law, and up to four children when you buy ACKO health insurance in India. The policy is available to individuals above 18 years of age, with dependent children aged between three months to 25 years being eligible.

| Eligibility Criteria | Allowed under Platinum Plans |

| Insured members | 10 Members |

| Policyholder’s age | 18 years and older |

| Dependent spouse’s age | 18 years and older |

| Dependent children’s age | 3 months - 25 years |

| Parents | 2 members |

| Parents-in-law | 2 members |

Common myths about health insurance are things that people believe are true. But in reality, they are just myths and should not be considered as a fact. Check the most popular medical insurance myths apart from the ones given below.

Here are the steps to follow if you wish to download the physical copy of your medical care insurance policy in India.

Yes you can get tax benefits from health insurance as it is an essential investment. Thus, the Government of India encourages everyone to buy the best health insurance plan by offering tax benefits on the premium paid under Section 80D of the Income Tax Act, 1961.

NRIs can buy health insurance in India for themselves when they visit and their families. This allows them to get the best medical treatment possible. India is an advanced, global medical center and offers top quality health medical infrastructure.

Porting your health insurance allows you to switch to a new insurer while keeping your existing benefits. If you're looking for better coverage, lower premiums, or improved customer service, health insurance portability is a great option.

Consider porting health insurance because of the following reasons.

Here are the steps to port your health insurance policy.

The benefits of porting ACKO health insurance are as follows.

Disease-specific health insurance plans are designed to offer targeted coverage for serious illnesses that usually require expensive and long-term treatment. One of the most important types of such plans is the Critical Illness Health Insurance Plan.

A critical Illness health insurance plan is a policy that provides a lump sum payout if you are diagnosed with a serious illness listed in the policy, such as cancer, heart attack, kidney failure, stroke, or major organ transplant. Unlike regular health insurance, which pays for hospital bills, this plan gives you a fixed amount of money that you can use however you need, whether it’s for treatment, medicines, second opinions, or even daily expenses if you can’t work for a while.

You need a critical illness health insurance plan because, critical illnesses can strike anyone, anytime, even if you’re young and healthy. And the treatment costs can be sky-high. For example:

A Critical Illness Health Insurance Plan acts like a financial safety net, so you don’t have to use your savings or take on debt during such tough times.

When buying health insurance, two terms often confuse people, pre-existing conditions and waiting periods. Let’s break them down.

Pre-existing conditions are any illnesses or health issues you already have before buying a health insurance policy. These could include.

If you’ve been diagnosed or treated for a condition before getting a health insurance plan, it’s considered pre-existing. Insurers ask about these conditions when you apply so they can assess your health risk. It’s important to be honest while filling in your health details, hiding them can lead to claim rejection later.

A waiting period is the time you have to wait before your insurance starts covering certain conditions or treatments. Even though your policy is active from day one, not everything is covered immediately. Here are the different types of waiting periods.

At ACKO, we believe in simple, no-stress health insurance. Some of our health insurance plans come with the following.

This means you don’t have to wait years to get the benefits you need today.

Common reasons for claim rejection and how to avoid them are listed below. Understand that getting your health insurance claim rejected can be frustrating, especially during a medical emergency. But the good news is, most rejections happen due to avoidable mistakes. Here are some common reasons why claims get rejected and what you can do to prevent them.

The Claim Settlement Ratio (CSR) is an important parameter in the insurance industry. It shows the percentage of claims settled by an insurance company against the total number of claims it receives. A high CSR could mean that the insurer is reliable and has a good track record of paying claims. Here’s why CSR matters and how it impacts your health insurance decision.

The Claim Settlement Ratio is calculated by dividing the number of claims settled by the insurer by the total number of claims received, and then multiplying by 100.

CSR = (Number of claims settled/Number of claims received)×100

Here is how CSR affects you as a policyholder.

Factors influencing the CSR are as follows.

You must renew your health insurance policy if you want uninterrupted medical coverage. The renewal process offers you a chance to assess the existing coverage and update the policy as well.

The contactless online method appears to be the ideal choice for renewing health insurance coverage in light of the recent pandemic. Here are steps to renew a medical plan online.

The following documents are required to buy medical insurance plans in India.

Note: The exact set of documents may vary depending upon the nature of claim.

Here are the documents required to raise a reimbursement claim.

When you stay healthy and don’t file any claims during a policy year, you get rewarded! This reward is called a No Claim Bonus (NCB). It's one of the best ways to get more value from your health insurance plan, without paying more.

A No Claim Bonus is a benefit you receive for not making any claims in a policy year. Insurers offer NCB in two ways.

Here are some examples of loyalty benefits.

July 22, 2025: News reports indicate that the GST Council may announce a significant tax cut on senior citizen health insurance premiums at its next meeting. Currently, an 18% Goods and Services Tax (GST) is levied on life and health insurance premiums. The council is considering waiving the GST on senior citizen health insurance premiums. It is also expected to eliminate the GST charged on health insurance premiums for coverage up to ₹5 lakh— a move aimed at making life insurance more affordable for people. This proposal is backed by the Insurance Regulatory and Development Authority of India (IRDAI) and the Group of Ministers (GOM) on insurance.

Health insurance is a financial product and can have many words that sound complex. So here are the meanings of some common terms related to health insurance.

Health insurance protects you against medical costs, but when combined with a 1 crore term life insurance coverage, your loved ones are fully protected financially. In the event of unforeseen circumstances, a term insurance policy gives your beneficiaries a sizable payout, enabling them to preserve their financial stability.

By securing both health and life insurance that suit your needs, you create a comprehensive strategy to safeguard your family’s health and financial future. Remember that selecting a good life coverage policy depends on what you need, your age, income, future goals and more. Using an online term life insurance calculator can make this process easier and help you make informed decisions.

The rising demand for Health Insurance can be attributed to the efforts of the new-age insurers to expand insurance accessibility, enhancing simplicity and transparency. And, this has led to the adoption of disruptive technologies to stay ahead of the competition Read more.

The realm of Health Insurance has undergone significant transformations, aligning with the evolving needs of individuals and families. In 2025, it's imperative to comprehend the nuances of Health Insurance policies to make informed decisions that align with your unique circumstances. Read more

Health insurance is not just a safety net for unexpected medical expenses; it's also a smart financial move that can help you save on taxes. Understanding how to leverage Section 80D of the Income Tax Act can ensure that you make the most out of your health insurance policy while optimizing your tax savings. Read more

The health and life insurance sectors are undergoing massive digital disruption. From AI-led automated underwriting to telemedicine platforms, insurers are embracing new-age technologies at scale to drive efficiency, personalisation and superior customer experiences amid evolving consumer expectations. Read more

ACKO has entered the retail health insurance industry with the goal of putting the consumer first through competitive pricing, convenience, and exceptional customer service Read more

Parentlane Co-Founder and CEO Vijay Anand will join the Acko leadership team and spearhead strategic initiatives for the company Read more

Healthcare sector of India has progressed immensely and the main contributing factors have been the advancement of medical technology along with the expansion of health insurance Read more

Digital insurer Acko General Insurance Ltd has forayed into retail health insurance to disrupt the sector, which is primarily dominated by offline players, a top company official said. Read More

Digital insurance provider Acko General Insurance is close to raising $100-150 million (around ₹820-1,200 crore) from new and existing investors. Read More

Have queries related to ACKO’s Health insurance policies? Refer to our Policy Wordings for detailed information or reach out to us via email or phone using the information below

Call us on 1800 266 2256

Select Language: English Hindi

Health Disclaimer: *Except for exclusions like maternity benefits, undisclosed diseases, etc. Please check policy wording for more details.

**In case the pre-existing disease surfaces after a policy is issued. However, at the time of claim, if it is found that the policyholder did not disclose any known pre-existing diseases while buying the policy, the claim may get rejected.