speak for ACKO

speak for ACKO

speak for ACKO

Home / Life Insurance / Articles / Life Insurance General / How to Raise EPF Complaints or Grievances on EPFO Portal

How to Raise EPF Complaints or Grievances on EPFO Portal

Team AckoDec 19, 2025

Share Post

When it comes to financial security in India, the Employee Provident Fund (EPF) plays a crucial role. Managed by the Employees' Provident Fund Organisation (EPFO), this fund scheme is a safety net for employees. However, there may be times when issues arise, such as delayed transfers, employer irregularities, or discrepancies in account details. Knowing how to lodge a complaint or grievance effectively is essential. This guide outlines the steps to use the EPFO portal and the dedicated EPF i-Grievance Management System to redress your EPFO grievances or EPFIGMS complaints faster.

Contents

- What is EPFiGMS?

- What is an EPF Grievance?

- Types of EPFO Grievances That Can be Registered on EPFiGMS

- Who Can Register a Complaint on EPFiGMS?

- When Should You Raise a Grievance?

- Things You Should Keep Ready Before Filing a Grievance

- Step-by-Step Guide to Raising a Grievance on the EPFO Portal

- How to Track Your EPF Grievance Status?

- How to Send a Reminder for a Pending Grievance?

- How to Use the UMANG App to Raise EPF Grievances?

- Tips for Faster EPF Grievance Resolution

- How Long Does It Take to Resolve an EPF Grievance?

- EPFO Helpline Number

- Conclusion

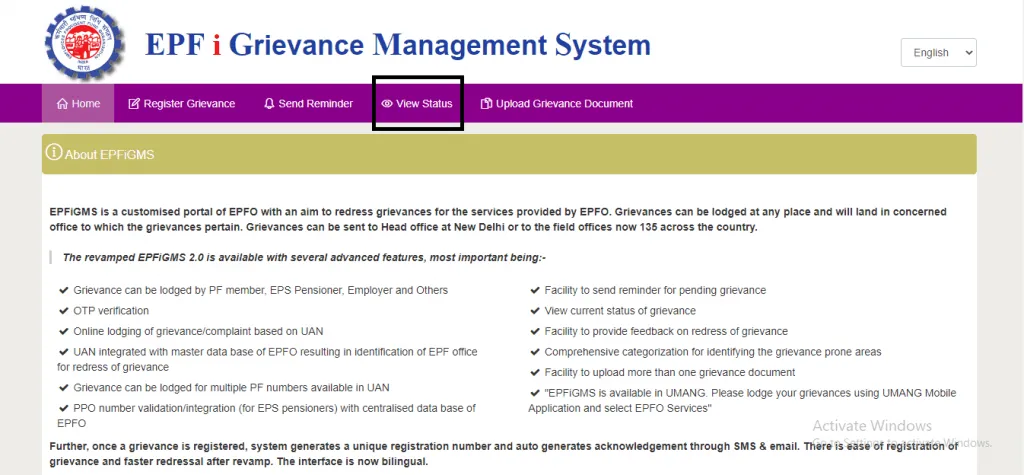

What is EPFiGMS?

The 'EPFiGMS' (EPF i Grievance Management System) is a customised grievance redressal portal on the EPFO website that helps resolve EPF complaints. All members of the EPFO portal can raise their PF complaints on the EPFIGMS login portal and keep regular EPF grievance status checks.

The EPF Grievance Management System makes it easier for its members to lodge EPF complaints and grievances without physically visiting the PF office.

The EPFiGMS status feature helps track updates and ensures transparency throughout the complaint resolution process.

What is an EPF Grievance?

An EPF grievance refers to any complaint or issue related to the services provided by the Employees' Provident Fund Organisation (EPFO). This can include concerns about procedural inefficiencies, delays in service delivery, or errors in personal data maintained by the organisation. To address these issues, individuals can use the dedicated online EPF grievance portal, which allows for easy submission and tracking of complaints.

Types of EPFO Grievances That Can be Registered on EPFiGMS

Queries regarding the PF Balance

Withdrawal of EPF

PF Online Payment

Transfer of PF accumulation to a new EPF account

EPFO Online Payment

Employees’ Pension Scheme (EPS) Certificate

Employees Provident Fund Organisation Office Reviews

Cheque - returned/misplaced

Payment of Insurance Benefits

EPFO Higher Pension Status

EPF Claim Settlement Time

PF Settlement Time

Any other EPFO Complaints or UAN Grievances

Who Can Register a Complaint on EPFiGMS?

The EPFiGMS platform is open to anyone who is facing an EPF-related issue. This includes:

EPF members who have active or past PF accounts

Pensioners who receive a monthly pension through the EPFO

Employers who manage PF accounts for their employees

Nominees or legal heirs of a member, if they have the required documents

As long as the user has valid PF-related details and a genuine grievance, they can register a complaint on the EPFiGMS portal.

When Should You Raise a Grievance?

You can lodge a complaint on the EPF complaint portal if you are experiencing any of the following issues:

The dispute has been resolved, but the funds have not been received.

PF transfer is not completed or refused

Error in service history or PF balance

Incorrect personal details linked with your UAN

Withdrawal or final settlement delayed

Pension payment issues (for which you can also send an EPF pension-related complaint email)

Any other PF-related issue

If you find yourself in any of the above situations, register an EPF complaint online so that your issue is resolved as soon as possible.

Things You Should Keep Ready Before Filing a Grievance

Before you start, it is advisable to have the details and documents ready:

Your UAN (Universal Account Number), which also helps if you want to check your EPF balance online with UAN

An email address and a mobile phone number

PF account number (if required)

Scanned copies of supporting documents relevant to your complaint with EPF

A well-written problem statement

Step-by-Step Guide to Raising a Grievance on the EPFO Portal

These are the steps to file a complaint on the EPFO website:

1. Visit the EPFiGMS Website

Visit the official EPFO website and then log in to EPFiGMS, a central portal for EPF grievances to lodge EPF pension-related grievances.

2. Choose the "Register Grievance" Option

You will find the registration option for a new complaint on the main page. To start the procedure, click on it.

3. Fill the Form with Your Data

Please provide the following:

UAN

Personal and contact information

PF account details

Please verify your details, especially if you have used the EPF balance check number, PF balance check mobile number, or EPF email ID recently for a complaint.

4. Select the Grievance Category

There will be several categories that will be showcased on the portal. These include:

Claim settlement issues

PF transfer problems

Account details mismatch

Pension-related issues (which can also be resolved through the EPF pension-related complaint email ID)

Withdrawal delays

Select the one that best describes your problem.

5. Explain Your Problem Clearly

Write your complaint in simple language. You can include information such as:

Dates

Reference numbers

When the problem began

Whether you previously raised this issue

Whether your employer is involved

6. File the Complaint

Once all the information is entered, click the "Submit" button. Once you have submitted:

A special EPF complaint number (registration number) will be provided

You will receive an email acknowledgement

Store this number safely as it will be required for checking the EPF complaint status later.

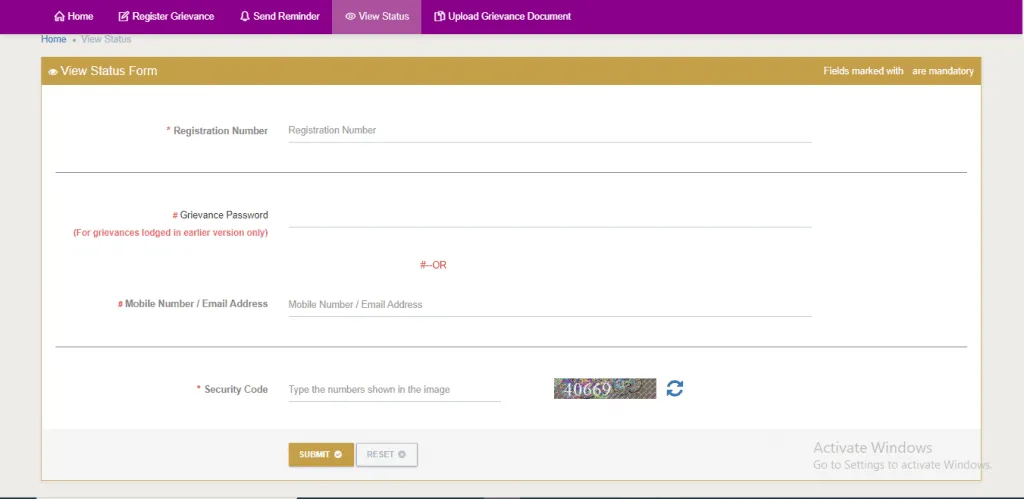

How to Track Your EPF Grievance Status?

To check your EPF complaint status:

1. Visit the EPFiGMS Portal

Use the same EPF grievance portal from which you have submitted your EPF complaint.

2. Open the "Check Status" Section

Click on the "Check Status" button.

3. Enter Your Registration Number

Enter:

Your EPF Grievance Redressal Number

Password

Mobile number or email ID

You can use the details that you might have utilised previously for checking the EPF claim status online or EPFO claim status tracking.

4. View the Current Status

You will see if:

The complaint has been forwarded

Action has been taken

More information is needed

The complaint has been resolved

You will get updates through emails, just like when you are checking the progress of the EPF withdrawal form online, the EPF claim portal, and the EPF claim form download.

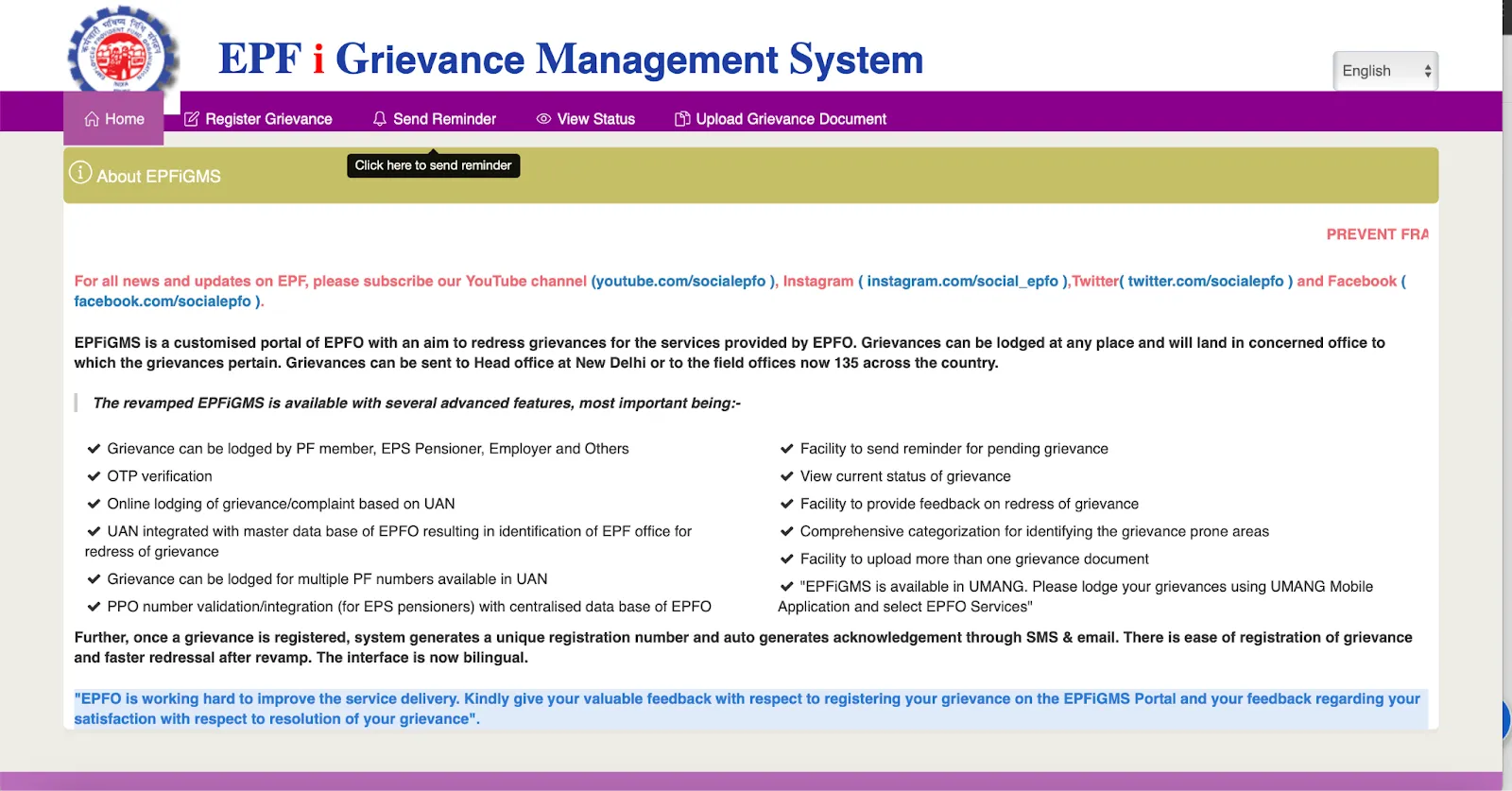

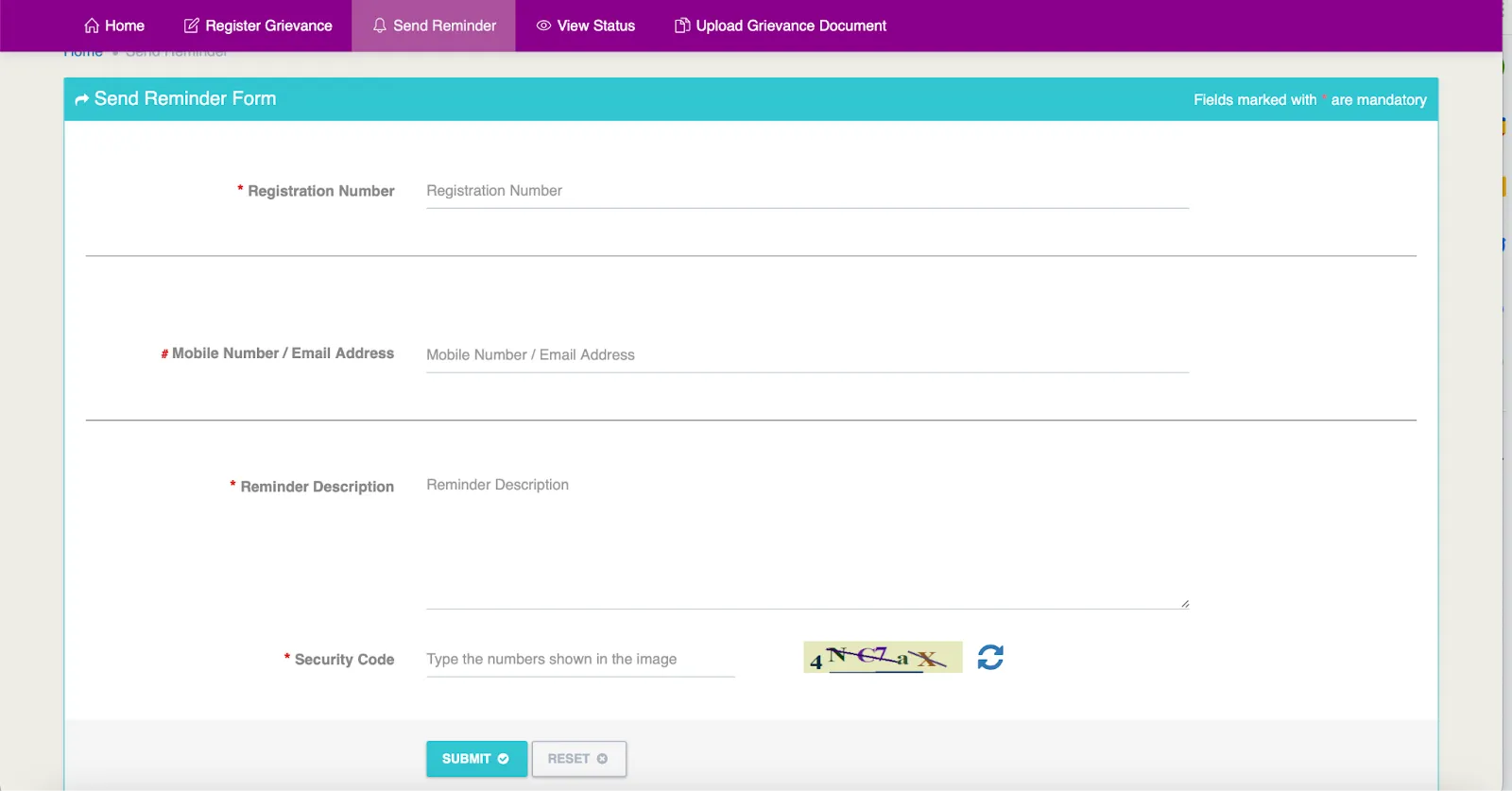

How to Send a Reminder for a Pending Grievance?

If you want to send a reminder for a pending EPF-related complaint or grievance, follow these steps:

Visit the EPFiGMS portal: https://epfigms.gov.in

Click on “Send Reminder”

Enter:

Registration number

Password

Mobile number or email ID

This notifies the EPFO office handling your case and works like re-alerting the EPF grievance cell.

How to Use the UMANG App to Raise EPF Grievances?

Apart from the portal, you can also use the UMANG app to raise EPF complaints, including any EPF-related complaints or EPF pension-related complaints.

Using the UMANG app, you can:

Start a formal EPF complaint

Track your EPF complaint status

Access and download your EPF passbook

Check EPF claim status

File for withdrawal or transfer

Modify your details

Follow these steps:

Launch UMANG

Open EPFO services

Select "Raise Grievance" or "Track Grievance"

Provide UAN and other details

File the complaint or check status

Tips for Faster EPF Grievance Resolution

To ensure quicker resolution:

1. Provide Accurate Details

Any incorrect details in the UAN number, PF number, or contact details may lead to a delay in your online EPF complaint.

2. Attach Supporting Documents

Add screenshots, bank statements, or receipts for claims.

3. Write a Clear Explanation

Speak in simple terms, and include key dates.

4. Monitoring Your Complaint Regularly

By using the EPF grievance portal or your EPF complaint number.

5. Keep Your Employer in the Loop

Some of the issues in PF require approval from the employer.

How Long Does It Take to Resolve an EPF Grievance?

The EPFO usually settles complaints within 15-20 days of registering the complaint. If it involves complex issues that require action from employers, it may take a longer period. You will continue to get updates via email. The process is very similar to the EPF balance check on mobile number, SMS, or EPFO claim status.

EPFO Helpline Number

The official EPFO (Employees' Provident Fund Organisation) helpline number (EPFO customer care number) is 1800118005. It is available on all working days from 9:15 AM to 5:45 PM.

You can also mail your queries to the following e-mail id:

If you are an employee: [email protected]

If you are an employer: [email protected]

You may also make a call at our toll-free number: 14470

Conclusion

The Employees' Provident Fund (EPF) is a fundamental pillar of financial security for millions of Indians. In the event of EPF-related issues, knowing that the EPFO has established robust systems to redress grievances effectively is reassuring.

Both the EPFO website and the specific EPF i-Grievance Management System (EPFiGMS) are designed to make claim registration and tracking easy. These sites address your grievances effectively and efficiently with features such as email reminders, EPFO grievance status check, and step-by-step guidelines for complaint registration. The grievance PF facility helps members identify procedural issues or delays.

Below are some of the frequently asked questions on How to Raise EPF-related Complaints

1.How much time does it take to approve a PF claim?

It takes around 20 working days for the claim EPFO settlement to be processed.

2. Should a complaint be filed on the member portal to transfer online claims?

Yes. It is mandatory to file a complaint on the portal.

3. Can a member use social media for grievance redressal?

Yes. A member can contact the EPFO via their social media handles. However, this will not be considered a formal complaint.

4. How long does it take for a complaint to be resolved?

The EPFO will aim to address the grievance within 30 business days.

5. Is there a helpline number for EPF grievances?

Yes. Members can call the EPF customer care number, EPFO helpline number, or PF complaint number at 1800-118-005. This EPF toll-free number serves as the official EPFO customer service number, UAN customer care number, and PF office helpline number for resolving all grievances.

6. Where can I make an EPFO registration online?

You can make an EPFO registration online on the EPF site (www.epfindia.gov.in).

7. In how many days PF Claim is settled online for illness?

The PF Claim Process for illness takes around 3-4 working days.

8. Where can I go to get in-person redressal for my EPFO grievances in Karnataka?

For in-person assistance with EPFO grievances in Karnataka, you can visit the EPFO Regional Office in Bangalore or any other nearby EPFO Sub-Regional Office.

9. Can I escalate the complaint to a higher authority?

Yes. The member can escalate the issue to the Grievance Redressal Officer at the regional EPF office.

10. How to contact the EPF Complaint Resolution Service?

You can use the complaint resolution service provided by EPF through the EPFiGMS portal or through the EPF complaint email ID.

11. How can I file an online complaint regarding my Employee Provident Fund?

You can visit the grievance website of EPF (EPFiGMS), select “Register Grievance,” provide your information, and register your complaint online with EPF.

12. What is the best website to raise EPF-related grievances?

The best website for lodging complaints about EPF is the official website of EPFiGMS.

13. Where to find customer support for EPF complaints?

The customer service facility is available through the EPF complaint website, the UMANG app, or the EPF complaint mail ID.

14. How do I submit a formal dispute against my EPF fund manager?

File a dispute case through EPFiGMS by choosing the relevant type of complaint.

15. What apps can help manage and report EPF issues?

Using the UMANG app, you can file complaints about EPF issues and also check the status of your claims.

16. How to resolve discrepancies in EPF payments through official channels?

You can file your complaint in EPFiGMS, attach documents, and check updates based on your EPF complaint number.

Disclaimer: The content on this page is generic and shared only for informational and explanatory purposes. It is based on several secondary sources on the internet, and is subject to changes.

Was this article helpful?

Recent

Articles

How to Transfer a Car Insurance to a New Owner in India

Nikhila PS Dec 31, 2025

10 Tips to Reduce Your Car Insurance Premium

Team Acko Dec 30, 2025

How to Choose the Right Travel Insurance Policy?

Team Acko Dec 30, 2025

Moratorium Period in Life Insurance

Neviya Laishram Dec 29, 2025

Who is an Appointee in Life Insurance?

Neviya Laishram Dec 22, 2025

All Articles

Want to post any comments?

ACKO Term life insurance reimagined

ARN:L0072 | *T&Cs Apply

Check life insurance